Income Tax Rates 2024 Singapore

Income Tax Rates 2024 Singapore. This tool is designed for simplicity and ease of use, focusing solely on income. Remaining taxes have retained existing.

The calculator is updated with the latest tax rates and brackets as per the 2024 tax year in singapore. Share market highlights on 27 may 2024:

Use Our Interactive Tax Rates Tool To Compare Tax Rates By Country Or Region.

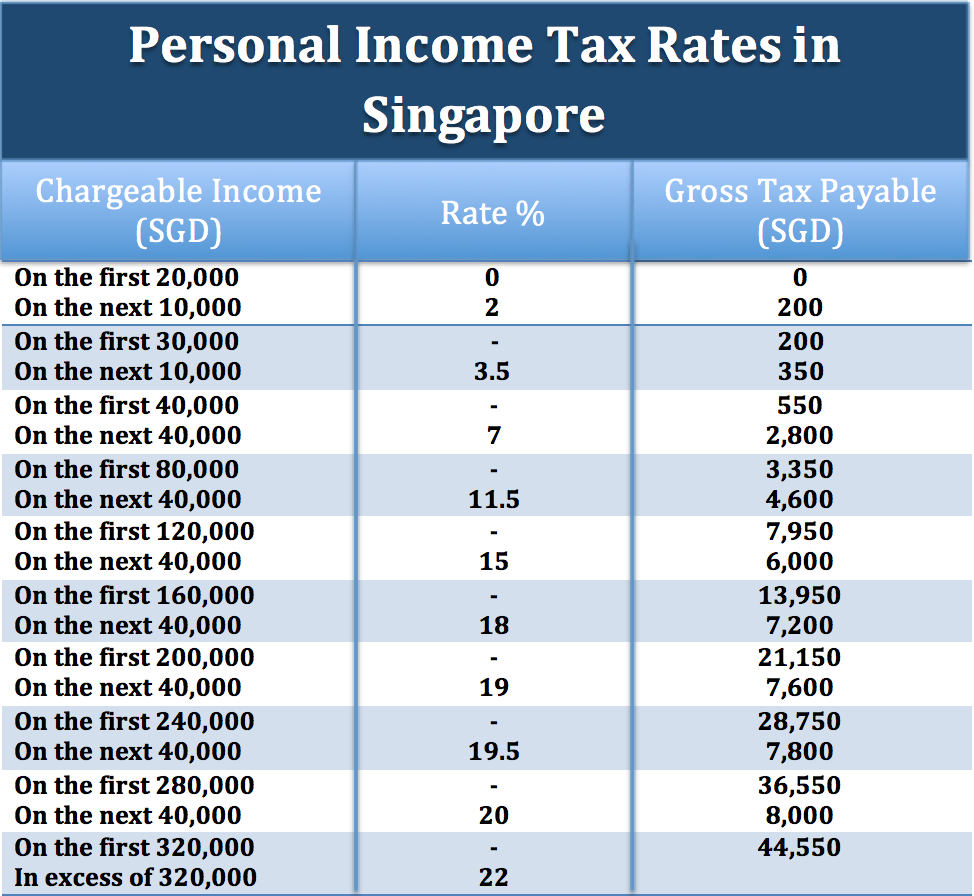

Current tax rates in singapore personal income tax rates/individual income tax rates.

1, Received First Reading In The House Of Commons.

To achieve greater progressivity, the top marginal personal income tax rate will be increased with effect from ya 2024.

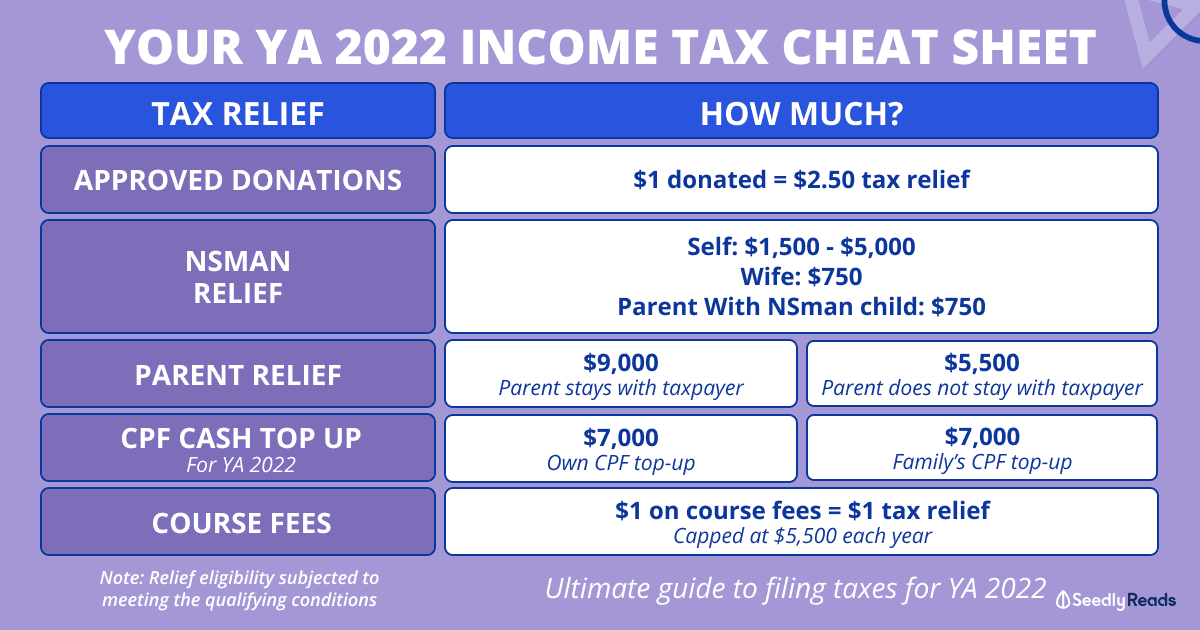

The Rebate Will Be 50% Of Tax Payable, Capped At.

Images References :

Source: www.notsocrazyrichasians.com

Source: www.notsocrazyrichasians.com

The Beginner's Guide to Tax in Singapore NSCRA, Individuals need not pay any inheritance tax or capital gain. Feb 17, 2024, 05:59 am.

Source: financialhorse.com

Source: financialhorse.com

Singapore Personal Tax Guide + Tax Rebate and Reliefs (2022, However, starting from 2024, the government has announced a 2% rise in the tax rate for individuals with the highest marginal income. Process for filing and paying personal income taxes.

Source: www.pelajaran.guru

Source: www.pelajaran.guru

Personal Tax Rates 2022 Singapore Air PELAJARAN, Singapore personal income tax tables in 2024. Singapore to raise personal income tax for top 1.2% of income tax payers to 23% to 24% in 2024.

Source: www.rbcrca.com.sg

Source: www.rbcrca.com.sg

A Guide to Singapore Personal Tax, Current tax rates in singapore personal income tax rates/individual income tax rates. The rebate will be 50% of tax payable, capped at.

Source: www.pilotoasia.com

Source: www.pilotoasia.com

Singapore Personal Tax Guide 2024 Locals & Foreigners, Personal income tax rates and rebate for year of assessment (ya) 2024. Felicia tan fri, feb 18, 2022 • 06:06 pm gmt+08 • 2 min read.

Source: awbi.in

Source: awbi.in

Singapore Tax Rate 2024 What Are Singapore Tax Rates and, Remaining taxes have retained existing. Feb 17, 2024, 05:59 am.

Source: www.rikvin.com

Source: www.rikvin.com

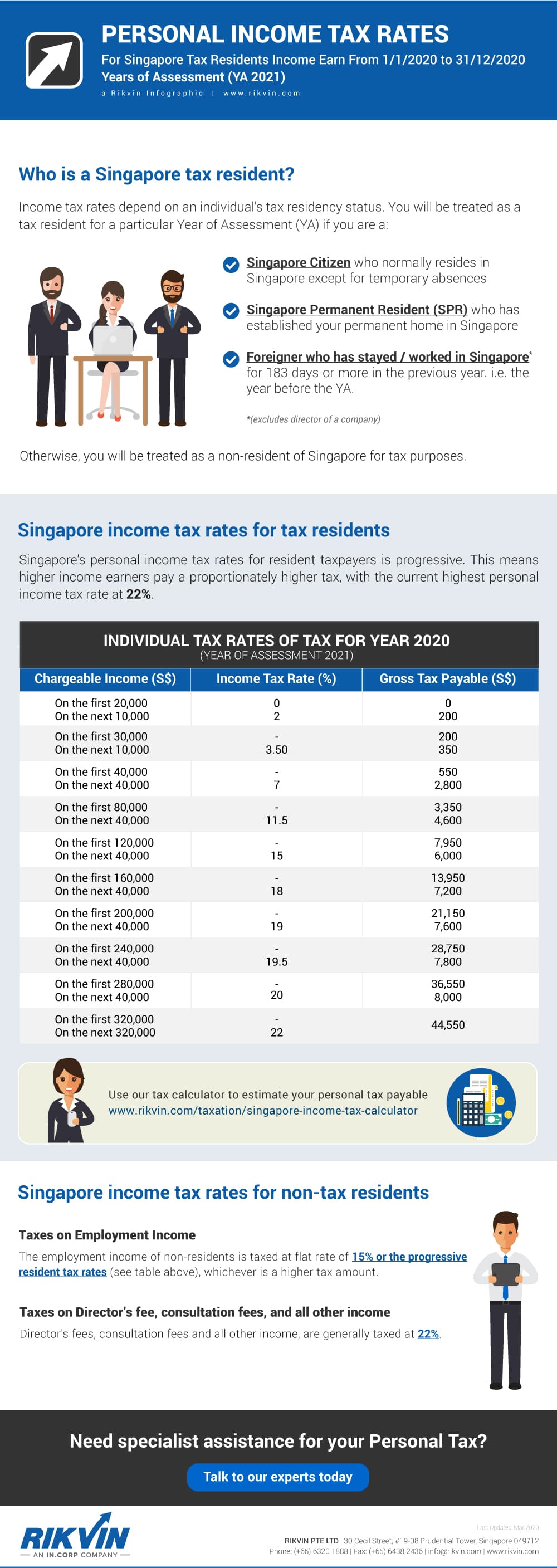

What is the Singapore Personal Tax Rates in 2021? Infographics, Feb 17, 2024, 05:59 am. To achieve greater progressivity, the top marginal personal income tax rate will be increased with effect from ya 2024.

Source: www.omy.sg

Source: www.omy.sg

Complete Guide To Personal Tax Rates And Brackets In, Quick access to tax rates for individual income tax, corporate income tax, property tax, gst, stamp duty, trust, clubs and. As announced in budget 2024, a personal tax rebate will be granted to all tax residents for year of assessment 2024.

Source: zmamall.com

Source: zmamall.com

Singapore Tax 2022 Guide Singapore Tax Rates & How to, Based on an individual's tax residency status, only tax residents for a particular year of assessment are liable to. Chargeable income in excess of $500,000 up to $1 million will be taxed at 23%, while that in excess of $1 million will be taxed at 24%;

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2024 year of assessment Just One Lap, The personal income tax rates for residents from ya 2024 onwards are: Complete guide to personal income tax rates and income brackets in singapore.

Chargeable Income In Excess Of $500,000 Up To $1 Million Will Be Taxed At 23%, While That In Excess Of $1 Million Will Be Taxed At 24%;

What kind of income is taxable?

Felicia Tan Fri, Feb 18, 2022 • 06:06 Pm Gmt+08 • 2 Min Read.

This tool is designed for simplicity and ease of use, focusing solely on income.